The Week Ahead – FRB Federal Reserve Bank’s quiet period or Blackout period is over

The FRB Federal Reserve Bank’s quiet period or Blackout period is over, The Fed members are again, free to entertain speaking engagements. If you remember last week, Chairman Powell and the FOMC (Federal Open Market Committee) announced the expected .25 rate hike.

The President’s State of the Union address is tonight @9 P.M. EST, 8 P.M. CST. Although you should be able to view his speech on any of your favorite news outlets, we don’t expect any market changing announcements of substance. Be on the ball if there is.

Tomorrow we have a few different members speaking throughout the day.

We also have WASDE report which can really move markets like beans, wheat, corn and other grains.

On the jobs front we do have a jobless claims report, pre market on Thursday at 7:30 a.m. CST. Finally for the week,

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

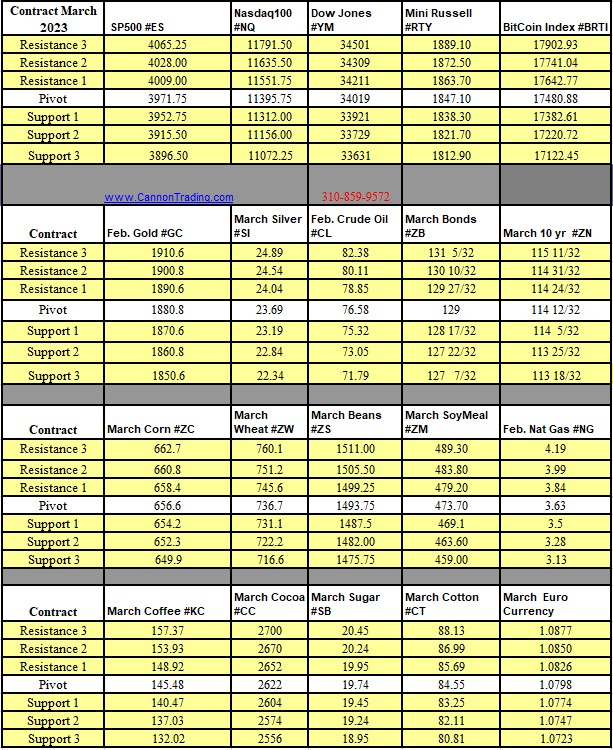

Futures Trading Levels

2-08-2023

Improve Your Trading Skills

Economic Reports, Source:

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.