Futures trading is a high-stakes arena that demands not only financial acumen but also emotional discipline. As an experienced futures trader or a newcomer to the field, continually improving your trading skills and strategies is crucial for success. Here’s a comprehensive guide to help you enhance your futures trading and make it a better experience.

Understand the Basics of Futures Trading

Before diving into strategies and improvements, it’s essential to have a solid understanding of what futures trading entails. Futures contracts are agreements to buy or sell an asset at a predetermined price at a specified time in the future. These contracts are standardized and traded on futures exchanges.

1. Emotional Discipline in Futures Trading

The real world of futures trading is intense and requires significant emotional discipline. Here are some tips to manage your emotions:

- Stick to Your Trading Plan: Develop a comprehensive trading plan and stick to it, regardless of market fluctuations.

- Avoid Overtrading: Trading too frequently can lead to emotional exhaustion and poor decision-making.

- Accept Losses: Understand that losses are part of trading. Accept them gracefully and move on.

2. Watch Your Risk Capital

Managing risk is paramount in futures trading. Here are some strategies:

- Set Stop-Loss Orders: These help limit your losses by automatically closing a position when the market reaches a certain price.

- Diversify Your Portfolio: Spread your investments across different assets to mitigate risk.

- Use Leverage Wisely: While leverage can amplify gains, it can also magnify losses. Use it judiciously.

3. Learn About the Market

A thorough understanding of the market you’re trading in is crucial. Here’s how to gain market knowledge:

- Stay Informed: Keep up with market news, economic indicators, and geopolitical events that might impact your trades.

- Study Historical Data: Analyzing past market behavior can provide insights into potential future trends.

- Join Trading Communities: Engage with other traders through forums, social media, and trading groups to exchange knowledge and experiences.

4. Dive into Futures Trading Cautiously

Starting cautiously can help you avoid significant losses. Here are some tips:

- Start with a Demo Account: Many brokers offer demo accounts where you can practice trading without risking real money.

- Begin with Small Positions: As you start trading with real money, begin with smaller positions to manage risk.

- Gradually Increase Exposure: As you gain confidence and experience, gradually increase your exposure to the market.

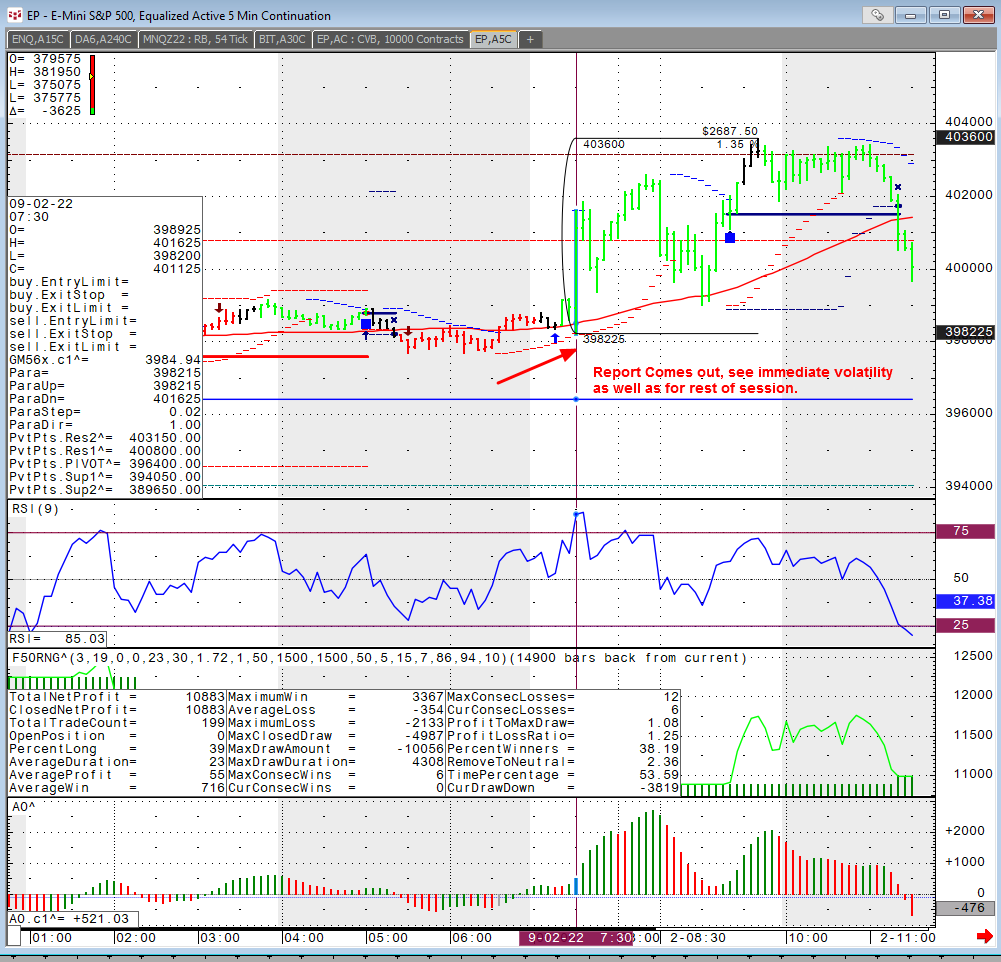

5. Using Technical Analysis

Technical analysis involves analyzing market data, primarily price and volume, to forecast future price movements. Here’s how to effectively use technical analysis:

- Learn Chart Patterns: Familiarize yourself with common chart patterns such as head and shoulders, double tops, and triangles.

- Understand Trend Analysis: Identify trends using tools like moving averages and trend lines to determine the market’s direction.

- Volume Analysis: Analyze trading volume to understand the strength of a price move. High volume often confirms a strong trend.

6. Integrating Technical Indicators

Technical indicators can provide additional insights and help you make informed trading decisions. Here are some popular indicators:

- Moving Averages: Simple Moving Average (SMA) and Exponential Moving Average (EMA) help identify trends and potential reversal points.

- Relative Strength Index (RSI): RSI measures the speed and change of price movements, helping identify overbought or oversold conditions.

- Bollinger Bands: These bands help identify volatility and potential price reversals by plotting standard deviations above and below a moving average.

- MACD (Moving Average Convergence Divergence): MACD helps identify changes in momentum, trends, and potential reversals.

Becoming a Better Futures Trader

To become a better futures trader, continuous learning and adaptation are key:

- Educate Yourself: Take courses, read books, and attend webinars to deepen your understanding of futures trading.

- Keep a Trading Journal: Document your trades, strategies, and outcomes to analyze your performance and identify areas for improvement.

- Seek Mentorship: Learn from experienced traders who can provide guidance and insights based on their experiences. As a brokerage firm in business since 1988, we have brokers that have been in the industry for about 30 years. You can make an appointment by calling 1(800)454-9572 to get some mentorship and advice.

Improving your futures trading involves a combination of emotional discipline, risk management, market knowledge, and the effective use of technical analysis and indicators. By adopting a cautious and informed approach, you can enhance your trading skills and make your futures trading experience more rewarding.

Remember, the key to success in futures trading is not just about making profits but also about preserving your capital and continuously learning and adapting to the ever-changing market dynamics.

To open an account with Cannon Trading Company, please click here.

Ready to start trading futures? Call US 1(800)454-9572 – Int’l (310)859-9572 email info@cannontrading.com and speak to one of our experienced, Series-3 licensed futures brokers and start your futures trading journey with E-Futures.com today.

Disclaimer – Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. Past performance is not indicative of future results. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this writing are of opinion only and do not guarantee any profits. This writing is for educational purposes. Past performances are not necessarily indicative of future results.

**This article has been generated with the help of AI Technology. It has been modified from the original draft for accuracy and compliance.

***@cannontrading on all socials.