Get Real Time updates and more on our private FB group!

The Importance of FOMC Meetings for Futures Traders

Futures traders are constantly seeking information and insights that can help them make informed trading decisions. One crucial event that captures the attention of futures traders around the world is the Federal Open Market Committee (FOMC) meetings. These meetings, conducted by the Federal Reserve, have a significant impact on financial markets, including the futures market. In this article, we will explore the importance of FOMC meetings for futures traders and how they can utilize the information to their advantage.

Firstly, it is important to understand what the FOMC is and why its meetings are significant. The FOMC is the monetary policymaking body of the Federal Reserve System, responsible for formulating policies that influence interest rates and the overall direction of the U.S. economy. The committee consists of the seven members of the Federal Reserve Board and five of the twelve regional Federal Reserve Bank presidents. The committee meets eight times a year to assess economic conditions, discuss monetary policy options, and make decisions regarding interest rates.

For futures traders, the decisions made during FOMC meetings can have a profound impact on the financial markets. One of the key areas of focus for futures traders is interest rates. Changes in interest rates can affect the cost of borrowing, consumer spending, business investments, and overall economic growth. Futures traders closely watch FOMC meetings for any hints or indications of potential changes in interest rates. These rate decisions can directly impact various futures contracts, including interest rate futures, currency futures, and stock index futures.

The FOMC meetings also provide valuable insights into the overall economic outlook. During these meetings, committee members discuss economic indicators, such as GDP growth, inflation rates, employment figures, and consumer spending. The statements and press conferences following the meetings offer traders a glimpse into the Fed’s assessment of the economy’s health and its future direction. Futures traders analyze this information to gauge the overall sentiment and potential market movements.

Cannon Trading Company, a renowned brokerage firm, recognizes the significance of FOMC meetings for futures traders. As an established provider of trading services, Cannon Trading Company offers its clients access to a wide range of futures markets, including E-Mini contracts. E-Mini contracts, such as E-Mini S&P 500 and E-Mini Nasdaq 100, are among the most actively traded futures contracts. Traders at Cannon Trading Company rely on the insights gained from FOMC meetings to make informed trading decisions in these markets.

The information obtained from FOMC meetings is particularly valuable for futures traders engaged in short-term trading strategies. These traders often take advantage of price volatility and short-term trends in the futures market. The announcements and press conferences following FOMC meetings often trigger significant price movements and increased trading volumes. Futures traders who are well-informed about the decisions and statements made during the meetings can capitalize on these opportunities.

In addition to interest rates and economic outlook, futures traders also pay attention to any changes in the Fed’s monetary policy stance. The FOMC may announce changes to its quantitative easing programs or provide guidance on its future plans. Such announcements can impact the bond market, currency markets, and commodity futures. Futures traders rely on this information to adjust their trading strategies and positions accordingly.

In conclusion, FOMC meetings hold immense importance for futures traders. The decisions, statements, and insights gained from these meetings have a direct impact on the futures market, including interest rate futures, currency futures, and stock index futures. Traders rely on this information to assess the direction of interest rates, gauge the overall economic outlook, and adjust their trading strategies accordingly. Companies like Cannon Trading Company offer traders access to these markets and recognize the significance of FOMC meetings in providing valuable insights for successful trading. By staying informed about the FOMC meetings and their outcomes, futures traders can gain a competitive edge in the dynamic world of futures trading.

The following are my PERSONAL suggestions on trading during FOMC days:

· Reduce trading size

· Be extra picky = no trade is better than a bad trade

· Choose entry points wisely. Look at longer time frame support and resistance for entry. Take the approach of entering at points where you normally would have placed protective stops. Example, trader x looking to go long the mini SP at 3925.00 with a stop at 3919.00, instead “stretch the price bands” due to volatility and place an entry order to buy at 3919.75 and place a stop a few points below in this hypothetical example ( consider current volatility along with support and resistance levels).

· Expect the higher volatility during and right after the announcement

· Expect to see some “vacuum” ( low volume, big zigzags) right before the number.

· Consider using automated stops and limits attached to your entry order as the market can move very fast at times.

· Keep in mind statement comes out at 1 Pm Central time, the news conference which dissects the language comes out 30 minutes later so the volatility window stretches out.

· Know what the market was expecting, learn what came out and observe market reaction for clues

· Be patient and be disciplined

· If in doubt, stay out!!

Plan your trade and trade your plan.

Projecting possible targets when trading futures

watch Video Below:

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

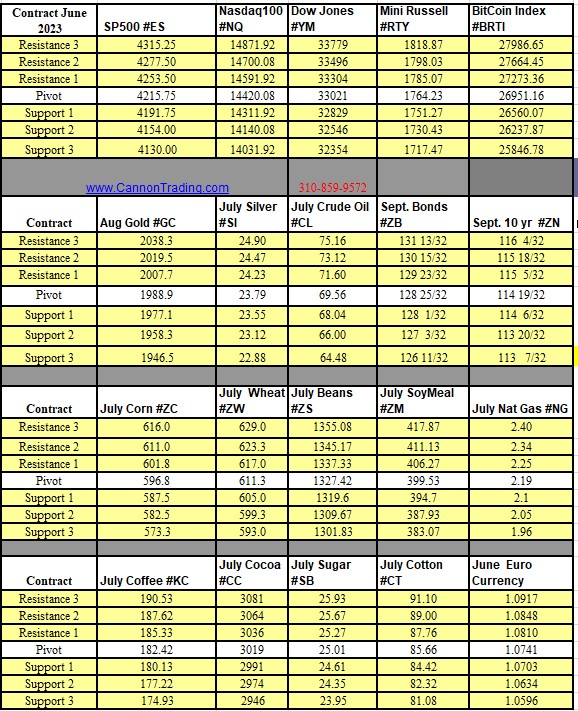

Futures Trading Levels

6-14-2023

Economic Reports, Source:

Forexfactory.com

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.