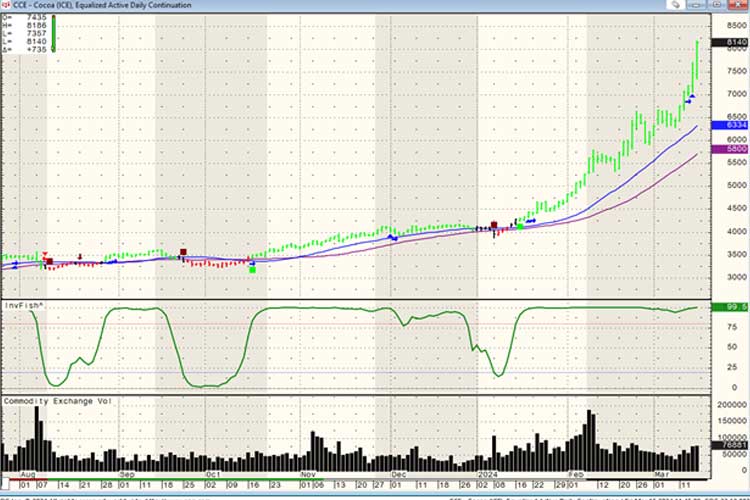

Cocoa futures trading has emerged as a pivotal component of the global commodities market, offering investors, traders, and manufacturers a vital tool for hedging against price volatility in the cocoa market. As of March 15th, 2024, cocoa futures are trading at all-time highs, with prices reaching $81.40. This remarkable price level reflects a confluence of factors, including market conditions and fundamentals in the Ivory Coast, the world’s leading cocoa producer. In this comprehensive analysis, we will explore the dynamics of cocoa futures trading, including contract specifications, trading hours, price movements per tick, and project future price trends based on the current market landscape.

Cocoa Futures: An Overview

Cocoa futures are standardized contracts traded on commodity exchanges, such as the Intercontinental Exchange (ICE), which allow market participants to buy or sell cocoa at a predetermined price for delivery at a future date. These contracts are essential tools for managing risk and discovering prices in the cocoa market, which is susceptible to fluctuations due to a variety of factors such as weather conditions, political instability in producing regions, and changes in global demand.

Contract Specifications

A standard cocoa futures contract on the ICE is for 10 metric tons of cocoa. The contracts are priced in dollars per ton, allowing participants to speculate or hedge against the future price movements of cocoa. These contracts have specific monthly expirations, with the most actively traded months typically being March, May, July, September, and December.

Exchange Trading Hours

Cocoa futures contracts are traded on the ICE platform, with trading hours extending from early in the morning until late in the afternoon, Eastern Time. This extensive trading window accommodates a global array of participants, from producers in West Africa to manufacturers in Europe and North America, ensuring liquidity and price discovery throughout the trading day.

Price Movement Per Tick

The minimum price movement, or “tick,” for cocoa futures contracts is $1 per ton. This means that the value of a single contract will change by $10 for every tick the price moves, providing traders with a clear and quantifiable measure of price volatility and potential profit or loss on their positions.

Current Market Conditions and Ivory Coast Fundamentals

The current all-time high prices of cocoa futures at $81.40 are reflective of a complex interplay of supply and demand dynamics. The Ivory Coast, as the largest cocoa producer globally, plays a significant role in setting the tone for the market. Several factors are currently influencing the market:

- Supply Concerns: Adverse weather conditions, such as overly dry or wet seasons, can significantly impact cocoa yields in the Ivory Coast. Recent concerns over drier-than-expected weather conditions have raised fears of a diminished harvest, contributing to the upward pressure on prices.

- Political Stability: The political environment in the Ivory Coast and neighboring countries can also affect cocoa production and supply chains. Stability in the region is crucial for ensuring uninterrupted supply to the global market.

- Global Demand: The recovery of global economies from the impacts of the COVID-19 pandemic has led to an increase in demand for luxury goods, including chocolate. This resurgence in demand, coupled with supply concerns, has contributed to the price surge.

Click here for more info on trading cocoa futures

Price Projections for Cocoa Futures

Looking ahead, several factors will influence the price trajectory of cocoa futures. If the current supply concerns due to weather conditions in the Ivory Coast persist, and demand continues to strengthen, prices could maintain their upward momentum or even rise further. Additionally, any geopolitical instability in the region could exacerbate supply disruptions, potentially driving prices higher.

The prospect of cocoa futures reaching the unprecedented level of $100 has sparked considerable interest in the commodities market, driven by a blend of supply constraints and robust demand. The primary catalyst behind this speculation is the delicate balance of supply and demand dynamics, particularly influenced by conditions in the Ivory Coast, the world’s premier cocoa producer. Supply concerns, such as adverse weather affecting crop yields or political instability impacting production, have the potential to significantly tighten the global cocoa supply. Concurrently, a resurgence in global demand for chocolate, fueled by economic recovery and increasing consumer indulgence in luxury goods, adds upward pressure on prices.

Should these supply challenges persist or escalate, alongside sustained demand growth, the push towards $100 could become more plausible. Market participants also watch for structural changes in the cocoa market, including sustainability efforts that might increase production costs, and shifts in consumer preferences towards premium chocolate products, which further strain supply. While reaching a $100 price point would be historic for cocoa futures, the unique convergence of supply issues and demand drivers suggests that such a scenario, though ambitious, is not beyond the realm of possibility in the commodities market’s ever-volatile landscape.

However, it’s important to note that the commodities market is inherently volatile, and prices can be affected by unforeseen developments. Improved weather conditions leading to better-than-expected harvests or fluctuations in global demand due to economic factors could temper the current price highs.

Cocoa futures trading at all-time highs underscores the volatile nature of the cocoa market and the crucial role of futures contracts in providing a mechanism for price discovery and risk management. As market participants closely monitor the developments in the Ivory Coast and the broader global economic indicators, cocoa futures will continue to be a dynamic and essential component of the commodities trading landscape. Given the current market conditions and fundamentals, traders and investors should remain vigilant, recognizing both the opportunities and risks present in the cocoa futures market.