Different Ways to “Attack the Trading Day Ahead”

By Ilan Levy-Mayer, VP

Many different ways to make and lose money trading futures, even more so when day trading.

Today’s action in stock index futures led me to write about the three main approaches out there, in my opinion, for day-traders to approach the trading day ahead:

The first is what I call the “trend is your friend”

A trader looks at few different time frames, looking to see if there is an established trend on longer time frame ( example 60 minutes chart) and then trying to look for pull back on lower time frames and “join the trend”. Only works for certain markets and only works few times of the month as most days markets do not have an intraday trend.

Second method is what we call break out. Traders will look for markets that have been in a lower volatility situation using indicators such as ADX, Volatility indicators, RSI for example. Then they will look at the chart to find what they feel are levels that if broken can fuel a stronger move in the same direction. These levels can be extracted visually looking at the chart or using highs/ lows of X periods. At times traders will scan for markets that have been in LOWER volatility with the expectation of a volatility breakout. This method works better on some markets than others. I noticed that crude oil and gold futures tend to have better chances of a continued breakout move than the mini SP 500 AS AN example.

The third one many traders use and believe in is “mean reversion”. Stock index futures in my opinion will fall into this category many trading days. Market will test previous day’s highs, then maybe test lows and will trade in between as the markets tries to establish new “value zones”. Traders will sometimes use RSI or Williams %R to get a feel for when the market gets away from the mean and will use counter trend methods in this case. Many will use volume profile, market profile in order to visualize levels of support and resistance. Use of stops, when counter trend trading is even more important as you do NOT want to get caught on the few days a month when these markets do incur a break out situation…..

Obviously, all methods have good days, bad days and I guarantee you, none of these methods work all the time on all markets. Knowing the above and trying to understand what method should be the primary method for the market YOU trade and which can be used as secondary can help you while trading.

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

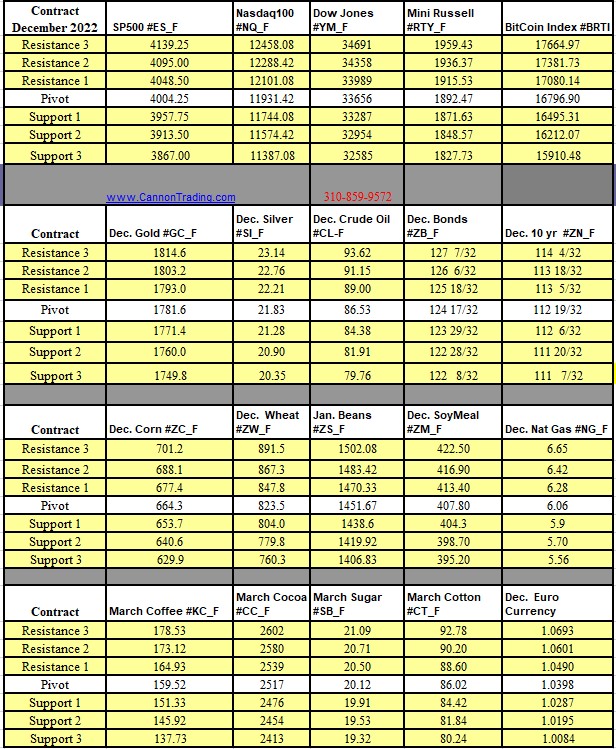

Futures Trading Levels

11-16-2022

Improve Your Trading Skills

Economic Reports, Source:

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.