Intraday Spread Trading?

One trading strategy worth considering for stock index traders is spread trading, where a single position in the market consists of the simultaneous purchase of one futures contract and sale of a related futures contract. In spread trading, the strategy involves gauging how the price difference between two futures contracts—the spread—will change. Spread trading is focused more on the price difference between the two contracts – often highly correlated – and less on the prices of the outright contracts themselves. One basis for employing spread trading is that it can be easier to take advantage of price discrepancies between two stock index futures than to predict price movements in either of the underlying contracts. Some of the most invested players in futures trading – and arguably the most sophisticated – include large speculators and commercial firms regularly employ spreads.

Because spread trades involve both a long and a short position in contracts that are related to each other, they are generally viewed as less volatile and therefore less risky than an outright position in a single contract. Additionally, since spread positions generally reflect lower market risk, there are lower margin requirements. For example, as of this blog post, the spread between one E-mini S&P 500 futures contract and one E-mini Nasdaq receives a 70% reduction from their combined initial margin requirements. The spread between the E-mini S&P 500 and the E-mini Dow Jones receives an 88% reduction in their combined initial margin requirements.

MORE TO FOLLOW>>>>>>

Plan your trade and trade your plan.

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

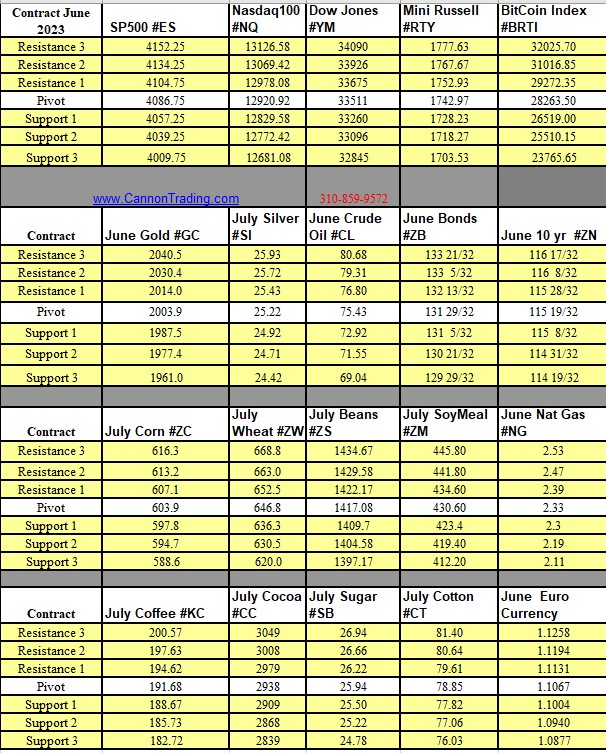

Futures Trading Levels

4-27-2023

Economic Reports, Source:

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.