The financial markets have long served as the backbone of global economic activity. Among the various instruments that traders employ, futures in trading have consistently stood out as one of the most effective ways to hedge risk and speculate on price movements. Despite recurring economic and social crises, traders have turned again and again to trading futures as a means of navigating financial uncertainty.

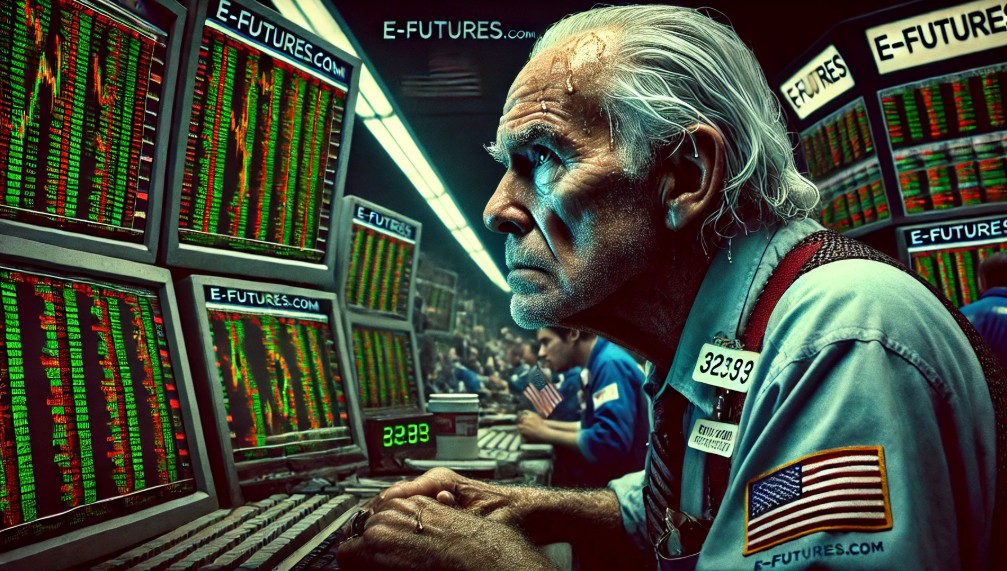

In an increasingly interconnected and volatile world, futures trading continues to serve a crucial role, satisfying the need for price discovery, liquidity, and risk management. Looking ahead to 2025, the future trading landscape is poised for further transformation, with technological advancements and market evolution shaping new opportunities. Moreover, platforms such as E-Futures.com and their high-performance trading system, CannonX, have become pivotal in facilitating successful trading future strategies.

Why Traders Turn to Futures in Times of Crisis

Throughout history, the financial world has been punctuated by economic downturns, recessions, and unexpected geopolitical upheavals. Yet, during these times, the futures in trading have remained a consistent vehicle for traders looking to either hedge their risks or capitalize on market inefficiencies. But why is this the case?

Futures in Trading: Hedging Against Uncertainty

Futures contracts allow businesses and investors to lock in prices ahead of time, which is particularly crucial during periods of inflation, supply chain disruptions, or currency fluctuations. For example, commodity producers use futures trading to secure prices and mitigate the risk of volatile price swings. Meanwhile, financial institutions rely on trading futures to hedge against stock market declines, interest rate fluctuations, or foreign exchange volatility.

Futures in Trading: Speculation and Profit Opportunities

While many traders use future trading as a risk management tool, others turn to it for speculative purposes. Price movements in commodity, stock index, and foreign exchange futures in trading provide ample opportunities for traders to capitalize on short-term price fluctuations. The ability to leverage capital and enter both long and short positions makes trading future an attractive option, particularly during economic downturns when traditional investment strategies may falter.

Futures in Trading: Market Liquidity and Price Discovery

The sheer volume of transactions in the futures trading market ensures liquidity, which is critical for efficient price discovery. In times of crisis, when uncertainty clouds valuation methods, trading futures allows investors to gauge real-time market sentiment, offering more transparency in pricing than traditional asset markets.

The Need for Futures in the Global Market

The futures in trading market serves a vital function in today’s global economy. Whether used for speculation or hedging, these contracts address several critical financial needs:

Stabilizing Volatile Markets

The global economy faces persistent challenges, from inflationary pressures to geopolitical conflicts and supply chain disruptions. The ability to trade futures provides a mechanism for stabilizing markets by enabling price predictability, reducing uncertainty for both producers and consumers.

Diversification and Portfolio Protection

Institutional and retail investors alike rely on futures trading to diversify their portfolios. Unlike traditional stock trading, trading futures allows access to various asset classes—including commodities, interest rates, and equity indices—offering a broader range of investment opportunities.

Efficient Leverage Use

Unlike stock investing, which requires full capital outlay, future trading allows traders to control large contract values with a fraction of the capital. This leverage provides significant profit potential, though it also increases risk, making expertise in trading future essential for success.

The Future of Futures Trading in 2025

The futures in trading landscape is continuously evolving, and 2025 promises further transformation in several key areas:

Advancements in AI and Algorithmic Trading

Artificial intelligence and machine learning continue to revolutionize futures trading by enabling data-driven decision-making. High-frequency trading future strategies leverage predictive analytics, allowing traders to anticipate price movements with greater accuracy than ever before.

Increased Retail Trader Participation

With technology making markets more accessible, retail traders are flocking to trading futures in increasing numbers. Commission-free platforms, improved education resources, and innovative mobile trading apps are breaking down barriers that previously made futures in trading the domain of institutional investors.

Regulatory Shifts and Market Transparency

The regulatory environment around future trading is constantly evolving. In 2025, we can expect stricter oversight aimed at protecting retail traders while ensuring market stability. These regulatory enhancements will further solidify the legitimacy of trading future as a viable investment approach.

Why E-Futures.com and CannonX are Great Choices for Futures Trading

For traders looking to excel in futures trading, choosing the right brokerage platform is just as important as selecting the right trades. E-Futures.com, powered by the cutting-edge CannonX platform, has garnered widespread recognition for its superior execution, accessibility, and compliance standards.

Top-Performing Trading Platform: CannonX

The CannonX trading platform provides traders with state-of-the-art tools for trading futures, including advanced charting, real-time data feeds, and high-speed order execution. In a world where milliseconds matter, CannonX ensures that future trading strategies are executed with unmatched precision.

Unparalleled Customer Support

Unlike many trading firms, E-Futures.com prioritizes trader accessibility. With 5 out of 5-star ratings on TrustPilot, clients consistently praise the firm’s broker phone availability and dedicated customer service team. Whether traders need assistance with trading futures strategies or technical support, expert guidance is always available.

Regulatory Excellence and Compliance

E-Futures.com has earned top-tier compliance ratings from industry regulators, reinforcing its commitment to transparency and trader security. In an industry rife with risks, trading on a well-regulated platform ensures peace of mind and legitimacy in futures in trading activities.

Knowledgeable and Experienced Brokers

The depth of expertise among E-Futures.com’s brokerage team sets it apart. With a deep understanding of future trading strategies, market trends, and risk management techniques, these professionals provide invaluable insights that help traders maximize profitability.

The resilience of futures trading in times of economic and social crisis underscores its enduring value in global markets. From risk mitigation to speculative opportunities, trading futures provides liquidity, transparency, and profit potential unmatched by other financial instruments. Looking toward 2025, innovations in AI, regulatory developments, and the expansion of retail participation will further shape the future of futures in trading.

For those seeking the best trading experience, E-Futures.com and its top-tier CannonX platform offer unmatched efficiency, security, and trader support. With a 5 out of 5-star rating on TrustPilot, excellent compliance credentials, and highly experienced brokers, it stands as the premier choice for those engaged in trading future strategies.

To open an account with E-Futures.com, please click here.

Ready to start trading futures? Call US 1(800)454-9572 – Int’l (310)859-9572 email info@cannontrading.com and speak to one of our experienced, Series-3 licensed futures brokers and start your futures trading journey with E-Futures.com today.

Disclaimer – Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. Past performance is not indicative of future results. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this writing are of opinion only and do not guarantee any profits. This writing is for educational purposes. Past performances are not necessarily indicative of future results.

**This article has been generated with the help of AI Technology. It has been modified from the original draft for accuracy and compliance.

***@cannontrading on all socials