Stop Getting Stopped??

By Mark O’Brien, Senior Broker

In our continued interest in assisting traders with strategy recommendations, here’s another look at one that can give short-term futures traders staying power in volatile markets. Any sound futures trading plan includes establishing the risk the trade will be taking – either in the form of a straight dollar amount, or a price point in the futures market you’re trading. The implementation of that plan typically involves the placing of a stop order to exit your futures position. One challenge to this plan is that it can lead to continuous exits and reentries in the market and an ongoing recalculation of your risk. This can be a repeated effort with mixed results, especially in volatile markets.

What if you could set up a trade with a risk toleration similar to an amount you would take with any straight futures trade, but with a greater price toleration and the “cost” to this would be a slightly reduced profitability that becomes less impactful to your trade as its profit increases?

I’m describing the straightforward purchase of an option that opposes the direction of your futures position. Let’s look at a timely example to paint a clearer picture.

At this blog’s writing the Dec. E-mini S&P 500 is trading at ±3705.00. If a trader decided to take a short position in the market and further decided – based on whatever technical indicators they used for guidance or a simple dollar amount – a risk of $1250 was appropriate for the trade, that would call for a placement of a 25-point BUY STOP order at 3730.00. Note the volatility in the market today. The Dec. E-mini S&P 500 has traded inside a nearly 100-point range (low = 3676.75 – high = 3774.25) and 3730.00 traded within the last few hours.

Setting aside an exit price for the moment, let’s look at an alternative strategy that involves entering the same short position at 3705.00 and at the same time incorporating the purchase of a 3705.00 call expiring tomorrow at 3:00 P.M., Central Time with a premium of ±25 points (±$1250). With this option in place your risk tolerance has been set to $1250 for the duration of the option’s lifespan, but your position’s tolerance to an adverse price has no limit. As far as an adverse move in the market your futures position might suffer, so too will the price of your option pay off. No matter how adverse the move, the risk on the trade will remain $1250 – the cost of the option.

The trade-off: by tomorrow at 3:00 P.M., Central Time, the market would have to move in favor of the position by at least the equivalent to the cost of the option (25 points), in order for the trade to begin profiting at the rate of a straight futures position. The market needs to move favorably enough to cover the cost of the option before the trade can turn profitable. Any favorable move by less than 25 points results in a commensurate reduction in the risk of the trade. For example, if at 3:00 P.M., Central Time the market is trading at 3695.00, the 10-point profit in your futures position partially offsets the 25-point cost of the option, resulting in a loss of $750.00.

The example above makes one important assumption, which is if the short futures position is below the option’s strike price at 3:00 P.M., Central Time, it is liquidated.

Also, you can adjust your risk depending on the opposing option you select, up or down the strike price ladder and the option’s expiration date. Of course, you would consider the risk parameters of any futures / futures option combination that will give you the needed perspective a trade like this has.

More on options here and specifically weekly options here.

As always, plan your trade and trade your plan. Please contact your broker or Cannon Trading with any questions.

Trader’s Checklist Click below on the image to play the VIDEO

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

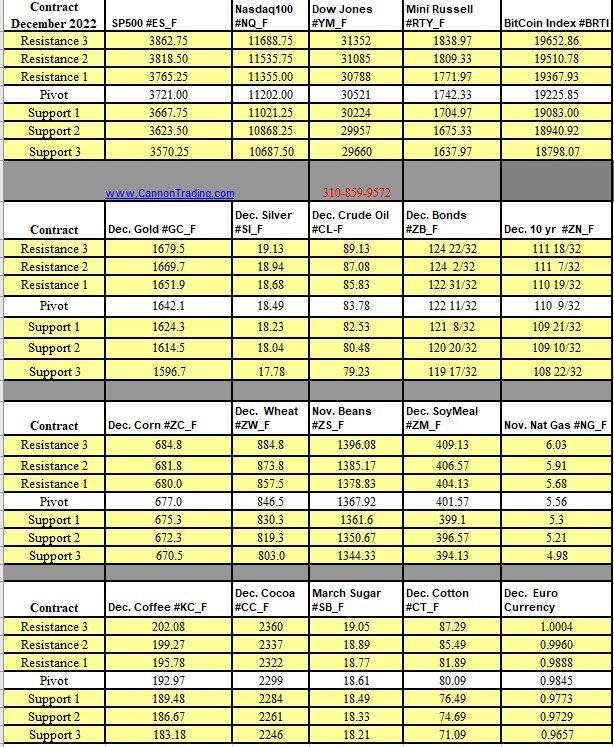

Futures Trading Levels

10-20-2022

Improve Your Trading Skills

Economic Reports, Source:

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.